In the realm of financial planning, life insurance stands as a cornerstone for securing the financial future of loved ones. With a myriad of options available, navigating the landscape of life insurance can be daunting. Hence, conducting thorough life insurance reviews becomes imperative for making informed decisions that align with individual needs and preferences. In this comprehensive guide from Captpromote, we delve into the essential factors to consider when evaluating life insurance policies.

Life Insurance Reviews

1. Financial Strength of the Insurer:

A crucial aspect of life insurance reviews revolves around assessing the financial stability of the insurer. After all, entrusting the financial security of your loved ones to a company demands confidence in its ability to fulfill its obligations. A.M. Best, Standard & Poor’s, and Moody’s are reputable sources providing insights into the financial strength and credit ratings of insurers. Opting for an insurer with a robust financial standing ensures peace of mind, knowing that your beneficiaries’ claims are secure.

2. Policy Features and Options:

Life insurance policies offer a myriad of features and options designed to meet diverse needs and circumstances. During the review process, it’s essential to thoroughly scrutinize the policy details to understand the scope of coverage, duration, and available add-ons like critical illness or disability riders. By assessing these elements comprehensively, you can customize the policy to align with your specific requirements, ensuring comprehensive protection for your loved ones and peace of mind for yourself.

3. Premiums:

Affordability plays a pivotal role in selecting a life insurance policy that aligns with your financial capabilities. Evaluating premiums across different insurers allows for comparison, ensuring that you secure competitive rates without compromising on coverage. It’s imperative to strike a balance between affordability and adequate coverage, thereby safeguarding your family’s financial well-being without stretching your budget.

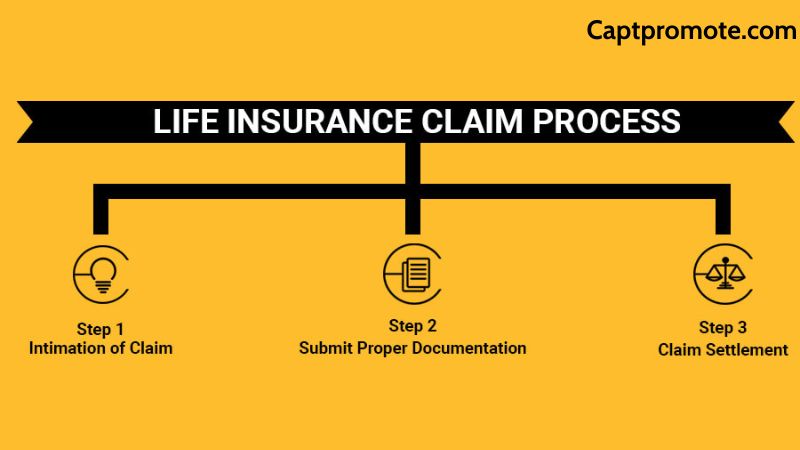

4. Claims Process:

The efficacy of an insurer’s claims process significantly impacts policyholder satisfaction. When conducting life insurance reviews, delve into the company’s reputation for processing claims efficiently and fairly. Insights from customer reviews and ratings offer invaluable perspectives on the insurer’s claims handling, enabling you to gauge the likelihood of a seamless experience during claim settlement.

5. Customer Service:

Exceptional customer service is instrumental in fostering trust and confidence in an insurer. Evaluate the accessibility, responsiveness, and helpfulness of the insurer’s customer service team through online reviews and testimonials. A company that prioritizes customer satisfaction and promptly addresses inquiries and concerns ensures a positive experience throughout the policy term.

6. Policyholder Satisfaction:

Gauging policyholder satisfaction provides valuable insights into the overall performance and reliability of an insurer. Reviews and ratings from existing policyholders shed light on their experiences, encompassing various aspects such as claims processing, customer service, and policy features. Considering the collective feedback of policyholders aids in making informed decisions and selecting an insurer renowned for its commitment to customer satisfaction.

7. Complaints and Regulatory Actions:

Scrutinizing complaints filed against an insurer with state insurance departments or regulatory bodies unveils any underlying issues or recurring problems. While a few complaints may be inevitable, a pattern of unresolved grievances warrants caution. Life insurance reviews encompass a thorough examination of any regulatory actions or disciplinary measures imposed on the insurer, serving as red flags indicative of potential shortcomings.

8. Flexibility and Customization:

Life is dynamic, and as circumstances evolve, the flexibility to adjust coverage becomes paramount. Opt for a policy that offers customization options, allowing you to modify coverage or beneficiaries as per changing needs. Flexibility ensures that your life insurance policy remains aligned with your evolving financial goals and obligations, providing comprehensive protection throughout life’s journey.

9. Underwriting Process:

The underwriting process forms the foundation of a life insurance policy, determining factors such as premiums and eligibility. Understanding the intricacies of the underwriting process, including medical exams and health questionnaires, is vital during life insurance reviews. Transparent communication regarding underwriting guidelines and their implications empowers you to make informed decisions while securing coverage tailored to your unique circumstances.

10. Reviews from Financial Advisors or Experts:

Drawing upon recommendations from trusted financial advisors or experts enhances the depth of insight gained from life insurance reviews. These professionals provide tailored guidance informed by your unique financial circumstances and objectives, directing you towards policies that best align with your long-term goals. By leveraging their expertise, you can navigate the complexities of life insurance with clarity and confidence, ensuring that you make informed decisions that safeguard your financial future effectively.

Sum Up

In conclusion, life insurance reviews serve as a cornerstone in the decision-making process, guiding individuals towards policies that offer comprehensive protection and peace of mind. By meticulously evaluating factors such as financial strength, policy features, customer service, and policyholder satisfaction, individuals can make informed decisions that safeguard their loved ones’ financial future. Embracing a proactive approach to life insurance reviews empowers individuals to navigate the ever-evolving landscape of financial planning with confidence and clarity.