Life insurance is not just a financial product; it’s a vital tool for safeguarding your family’s financial security in the event of your passing. Whether you’re starting a family, planning for retirement, or simply seeking peace of mind, understanding the intricacies of life insurance is paramount. In this detailed life insurance buying guide, Captpromote will explore every aspect to empower you to make informed decisions about protecting your loved ones’ future.

Life Insurance Buying Guide

Assess Your Needs:

Begin your life insurance journey by evaluating your financial situation and future obligations. Consider your current debts, mortgage, daily expenses, and any future financial responsibilities such as children’s education or retirement savings for your spouse. Understanding your financial obligations will help you determine the amount of coverage you need to provide for your family’s needs.

Understand Different Types of Life Insurance:

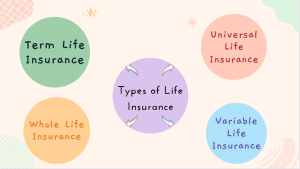

Life insurance comes in various forms, each with its unique features and benefits. Familiarize yourself with the main types:

- Term Life Insurance: Offers coverage for a specific period, usually 10, 20, or 30 years, and pays out a death benefit if you die during the term.

- Whole Life Insurance: Provides coverage for your entire life and includes a cash value component that grows over time.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest, offering flexibility in premiums and death benefits.

- Variable Life Insurance: Allows you to invest the cash value in various investment options like stocks and bonds.

Understanding the differences between these types of insurance will help you choose the one that aligns best with your financial goals and needs.

Calculate How Much Coverage You Need:

Determining the right amount of coverage is critical when purchasing life insurance. Use online calculators or consult with a financial advisor to estimate your coverage needs. Consider factors such as your income replacement needs, outstanding debts, funeral expenses, and future financial goals. Aim for a coverage amount that provides financial security for your family’s future.

Compare Quotes:

Shopping around is essential when buying life insurance. Obtain quotes from multiple insurance companies to compare premiums and coverage options. Look beyond the cost and consider factors such as the insurer’s financial stability, customer service reputation, and the range of policy options available. Additionally, evaluate optional riders that may enhance your coverage, such as disability income or long-term care riders.

Assess the Financial Strength and Reputation of the Insurer:

Choose an insurance company with a strong financial standing and a reputation for reliability. Research the insurer’s financial strength ratings from agencies like A.M. Best, Standard & Poor’s, or Moody’s. Additionally, read customer reviews and testimonials to gauge the insurer’s reputation for claims processing and customer service. A financially stable and reputable insurer will provide peace of mind that your policy will be honored when needed.

Understand Policy Terms and Conditions:

Before finalizing your life insurance purchase, thoroughly review the policy terms and conditions. Pay close attention to the coverage details, exclusions, limitations, and any penalties or fees associated with the policy. If you have any questions or concerns, don’t hesitate to seek clarification from your insurance agent or company representative. Understanding the fine print will ensure that you are fully aware of your policy’s terms and benefits.

Complete the Application Process:

Once you’ve selected a policy, complete the application process accurately and honestly. Provide detailed information about your health, lifestyle, and medical history. Depending on the type and amount of coverage, you may need to undergo a medical examination to assess your health and insurability. Be truthful and transparent during the application process to avoid any complications or delays in the future.

Review and Update Your Policy Regularly:

Life insurance needs can evolve over time, so it’s essential to review your policy regularly. Conduct an annual review to ensure that your coverage still meets your needs, especially after significant life events such as marriage, birth of a child, or career changes. Additionally, update your beneficiaries as needed to reflect any changes in your family or estate planning. Regularly reviewing and updating your policy will ensure that it continues to provide adequate protection for your loved ones.

Seek Professional Advice:

Navigating the complexities of life insurance can be daunting, so don’t hesitate to seek professional guidance. Consult with a financial advisor or insurance agent who can provide personalized advice based on your unique financial situation and goals. An experienced advisor can help you understand your options, compare policies, and select the coverage that best meets your needs and budget. With expert guidance, you can make informed decisions about protecting your family’s financial future.

Keep Important Documents Secure:

Once you’ve purchased a life insurance policy, it’s essential to keep all important documents secure. Store your policy documents, contact information for the insurer, and beneficiary designations in a safe and accessible place known to your loved ones. Inform your beneficiaries about the existence and location of the policy, ensuring that they can easily access the necessary information in the event of your passing. Keeping your documents organized and secure will streamline the claims process and ensure that your loved ones receive the financial support they need during a difficult time.

Sum Up

In conclusion, purchasing life insurance is a significant decision that requires careful consideration and planning. By following this comprehensive life insurance buying guide, you can navigate the process with confidence and make informed decisions to protect your family’s financial future. Remember to assess your needs, understand the different types of insurance, compare quotes, and seek professional advice when needed. With the right coverage in place, you can have peace of mind knowing that your loved ones will be taken care of no matter what life brings.