The life insurance market stands as a pillar of the broader insurance industry, offering individuals and families financial security and peace of mind in the face of life’s uncertainties. With its diverse range of products and services, this market plays a crucial role in safeguarding against the financial implications of unexpected events such as premature death or disability. In this article, Captpromote delve into the intricacies of the life insurance market, examining its key components, trends, and the role it plays in the lives of consumers.

Understanding the Types of Life Insurance

Life insurance comes in various forms, each tailored to meet specific needs and preferences. Term life insurance, providing coverage for a specified period, offers affordability and simplicity. Whole life insurance, on the other hand, provides lifelong coverage with a guaranteed death benefit and a cash value component that accumulates over time. Universal life insurance offers flexibility in premium payments and death benefits, while variable life insurance allows policyholders to invest in sub-accounts tied to the performance of financial markets.

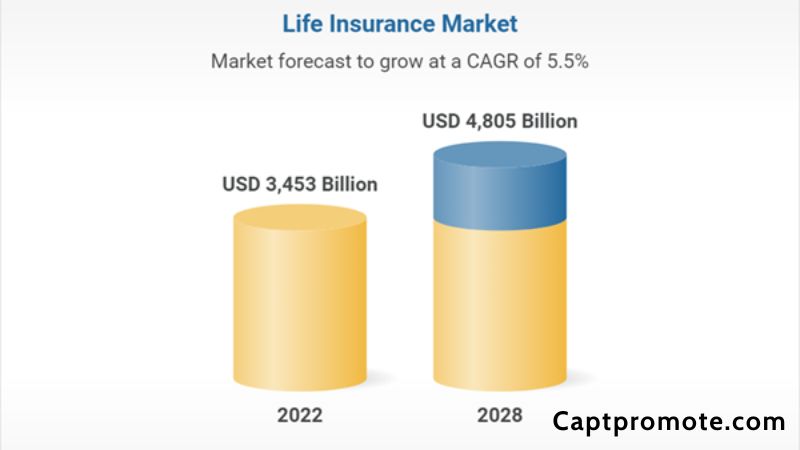

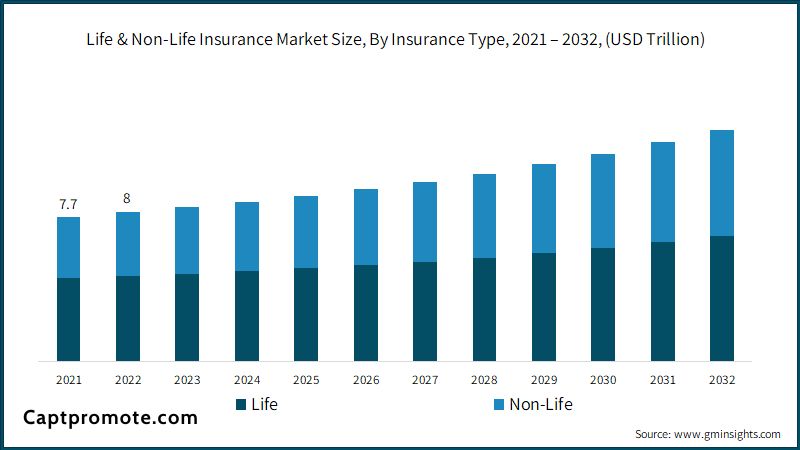

Life Insurance Market Size and Growth

The size and trajectory of the life insurance market differ significantly across regions and countries, shaped by various factors such as economic conditions, regulatory landscapes, and cultural norms. In developed economies, the market is often mature, marked by stable growth rates and fierce competition among insurers striving to capture market share. Conversely, emerging markets present substantial growth opportunities driven by factors like rising incomes, growing awareness of the importance of financial protection, and the expansion of distribution channels to reach previously underserved populations. These dynamics underscore the diverse nature of the life insurance sector, with each region offering unique challenges and opportunities for insurers to navigate.

Market Players and Competition

Within the life insurance market, a rich tapestry of participants exists, spanning from multinational giants to localized regional firms and cooperative mutual companies. Amidst fierce competition, these entities vie for dominance through a blend of competitive pricing, pioneering product offerings, and exemplary customer care. In this dynamic arena, standing out from the crowd is imperative, driving insurers to craft distinctive value propositions that resonate with consumers, fostering loyalty and long-term relationships. Each player navigates this landscape with strategic agility, aiming to capture market attention and secure a foothold in the ever-evolving realm of life insurance.

Regulatory Landscape

Given the critical role Life insurance plays in safeguarding consumers’ financial well-being, it is subject to stringent regulation by government authorities. Regulations govern various aspects of the market, including solvency requirements, product disclosures, sales practices, and capital reserves. Compliance with these regulations is paramount for insurers to ensure the protection of policyholders and maintain the stability of the market.

Distribution Channels

Life insurance products are distributed through a myriad of channels, including insurance agents, brokers, financial advisors, bancassurance, and direct sales channels. Each distribution channel serves distinct customer segments and offers unique advantages in terms of reach, convenience, and customer engagement. Insurers must strategically leverage these channels to maximize market penetration and meet the diverse needs of consumers.

Trends and Innovations

The life insurance market is not immune to the winds of change, with technological advancements, shifting consumer preferences, and regulatory developments driving innovation and transformation. Insurers are increasingly embracing big data and artificial intelligence to streamline underwriting processes, personalize offerings, and enhance risk management practices. Moreover, the advent of digital distribution channels has revolutionized how insurers engage with consumers, offering greater accessibility and convenience.

Demographic Influences

Demographic trends, such as aging populations and changing family structures, exert a profound influence on the life insurance market. Insurers must adapt their product offerings and distribution strategies to cater to the evolving needs and preferences of different demographic segments. For instance, millennials may prioritize flexibility and digital convenience, while retirees may seek guaranteed income streams and legacy planning solutions.

Risk Management

Effective risk management lies at the heart of the life insurance market, ensuring insurers can honor their policyholder obligations while maintaining financial stability. Insurers employ a range of risk management techniques, including underwriting, risk pooling, and reinsurance, to mitigate exposure to adverse events and fluctuations in financial markets. By prudently managing risks, insurers can instill confidence among consumers and regulators alike, fostering long-term sustainability and growth.

Conclusion

In conclusion, the life insurance market serves as a cornerstone of the broader insurance landscape, offering individuals and families invaluable protection against life’s uncertainties. From term life insurance to whole life and universal life policies, insurers provide a diverse array of products tailored to meet varying needs and preferences. In navigating this dynamic market, insurers must navigate regulatory complexities, embrace technological innovations, and adapt to shifting consumer demographics. By doing so, they can fulfill their mission of providing financial security and peace of mind to millions of policyholders worldwide. As the life insurance market continues to evolve, it remains poised to play an indispensable role in shaping the financial futures of individuals and families for generations to come.